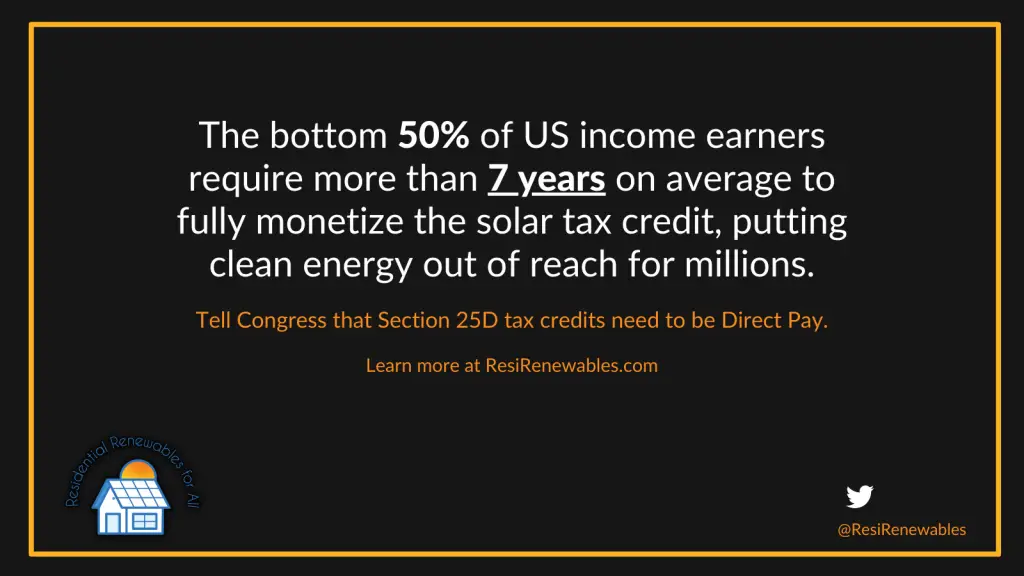

One social justice/equity issue facing the solar industry is that the Federal Solar Tax Credit (26% of the cost of the entire solar project, permits, materials, labor, electrical upgrades) does not help out low-moderate family households go solar as easily as more affluent households.

There is a letter to Congress that you can sign onto encouraging lawmakers to modify the Federal Solar Tax Credit, so that instead of it being a Tax Credit program, it becomes a Direct Pay program, decreasing the time in which solar customers get reimbursed for going solar.

Direct pay for Section 25D homeowners will:

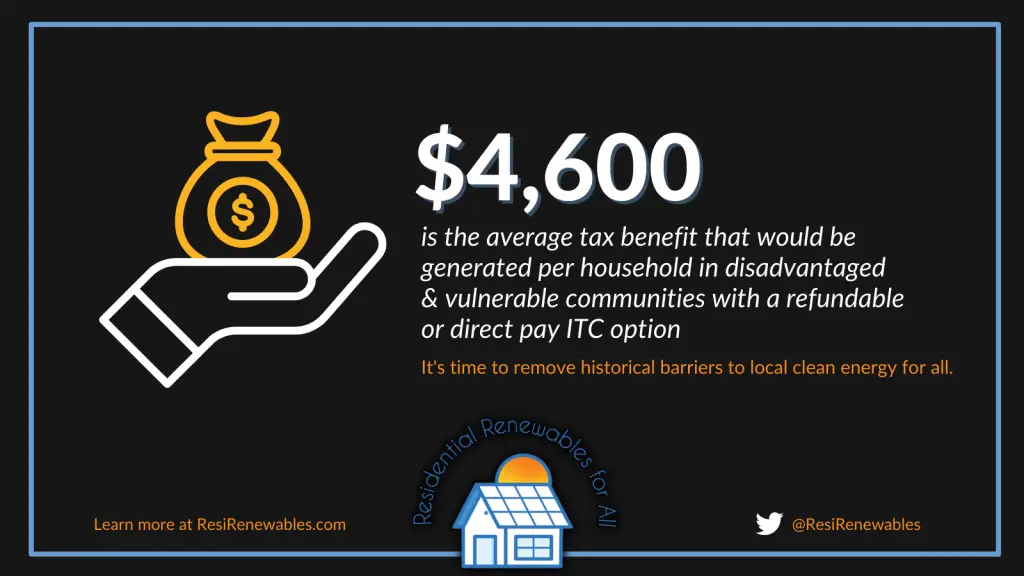

- Allow LMI families to receive their entire subsidy in a single year, freeing up the capital to purchase renewable energy systems.

- Increase energy independence and expand rooftop solar in an under-served and under-represented market.

- Guarantee lower and more reliable electric bills for families that need it the most.

- Create local jobs in a high-demand industry.

- Advance the President’s Justice40 agenda by broadening ownership of residential renewable energy systems.

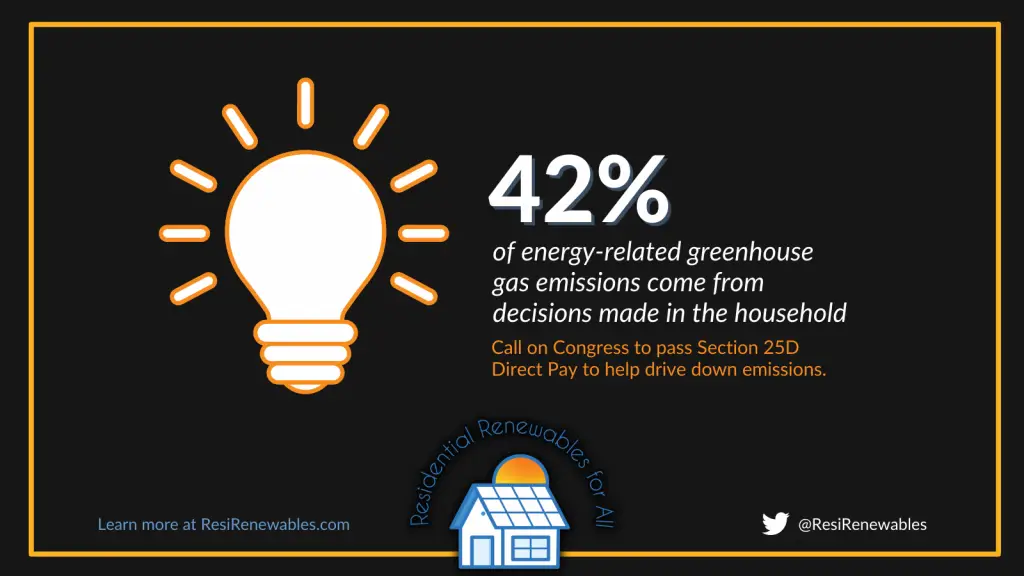

- Mitigate catastrophic climate change impacts.

Please consider signing the letter to Congress and sharing this message with your friends and colleagues on social media to amplify importance of this proposal.

Join the more than 300+ environmental justice organizations, environmental advocacy groups, and clean energy companies that have so far signed on to the Residential Renewables for All letter to Congress calling for Section 25D direct pay.