We like to keep people updated regarding the various solar incentives as they do change over time and 2022 includes a scheduled change as well as the possibility of significant changes to Federal incentives. We’ll start off focusing on the known incentives and then discuss some of the potential changes we may see if the Biden Administration’s Build Back Better bill passes.

The Known …

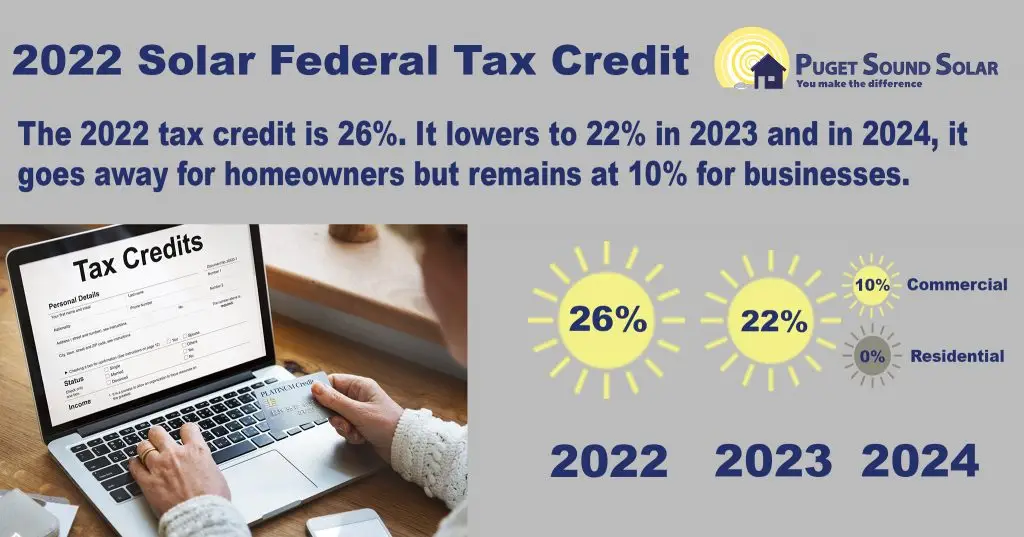

As we begin 2022, there is a 26% Federal Investment Tax Credit, (ITC) for solar and solar+energy storage projects installed by 12/31/22. In 2023, this tax credit is scheduled to be lowered to 22% and there is no Federal incentive available for homeowners beginning on January 1, 2024. Businesses follow the same step-down but a 10% tax credit will continue to be available for them in perpetuity.

The Federal tax credit covers all the material, labor, permit fees and any related electrical or structural (updating electrical panels, strengthening rafter beams and trench work for example) upgrades needed to complete the installation. Re-roofing does NOT qualify for the tax credit.

There is no sales tax for solar PV sales in Washington state, an approximate 10% savings.

Net-Metering is another important solar incentive in Washington where you trade kilowatt-hours (kWh) via an agreement with your utility. If your home or building is producing more electricity than it is using, the excess flows out to the grid, building kilowatt credits with your Utility, a.k.a., “running your meter backward.” We get 74% of our solar access over six months of time, spring, summer and early fall, so Net-Metering essentially serves as your “storage” for over-production during the sunny months that you get back on a 1-1 basis from your Utility as needed.

Over the years some utilities have offered additional financial incentives for their customers so it’s always a good idea to check in with your electrical utility to see if anything additional is available.

The Unknown …

As we write this blog post, the Biden Administration’s Build Back Better bill passed is in limbo as a lone democratic Senator, Joe Manchin from West Virginia opposes the legislation. The bill already passed Congress but is one vote short of approval in the Senate.

If approved, the Build Back Better bill would make significant changes to the way Federal programs supports renewable energy while also addressing some environmental justice issues.

Build Back Better’s proposed changes include:

Adjusting the ITC to 30% through 2026.

A 10 year extension of the ITC.

Direct pay instead of a tax credit, making solar more affordable to low to moderate households.

Prevailing wage and apprenticeship requirements to take full 30% value.

Additional 10% for projects in low-income communities.

Additional 10% for projects in former, gas, oil and coal communities.

Additional 10% for meeting domestic content requirements.

30% ITC for energy storage.

30% ITC for transmission above 250 kV.

Tax credits for new domestic clean energy manufacturing production.

$3 billion in climate and environmental justice block grants.

Stay Tuned …

Given the current stalemate regarding the Build Back Better bill it’s hard to give our customers a definite answer regarding possible financial incentives beyond this calendar year. Without the Build Back Better bill passing, the current Federal incentives expire for homeowners at the end of 2023.

Again, there is a scheduled step-down from 2022 to 2023 from 26% to 22% for the Federal Investment Tax credit. A 26% of tax credit on a $25,000 system is $6,500 and a 22% tax credit is $5,500, a difference of $1,000. Our current lead time is about three months out so in reality there’s only about eight months left for homeowners to ensure they get at least the 2022 26% tax credit before it lowers to 22% in 2023.

Contact your Senators via the Solar Energy Industries Association online form and let them know you support the Build Back Better bill and that you want them to vote yes.

If you’re interested in going solar, we strongly suggest you get in contact with us sooner rather than later to get a free solar quote and reserve a spot on our installation calendar in 2022 if you want to ensure getting at least the 26% tax credit.

You can get set up for your free quote by giving us a call at 206-706-1931 or by filling out the contact form below and telling us a little bit about your project.